WHAT IS GOAL?

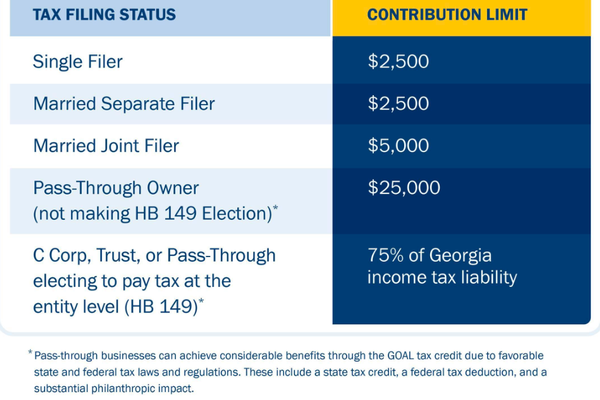

Individuals and businesses may redirect tax dollars to the GOAL Scholarship Program.

You are already paying income taxes to the state. Why not redirect some of those taxes to provide tuition assistance to financially eligible Athens Christian students?

Since 2008, ACS has partnered with the Georgia GOAL Scholarship Program, a Student Scholarship Organization (SSO) created through the Georgia Education Expense Tax Credit Program. This program enables Georgia residents, corporations, trusts, LLCs, and partnerships the opportunity to designate a portion of their state tax liability to the school's financial aid program. There is virtually no cost to participate, but your support has a tremendous impact on ACS’ ability to provide financial aid to students and families in need.

This is a proven opportunity that is a win-win-win for taxpayer donors, scholarship recipients, and our school community. By simply contributing to Georgia GOAL for a 100% Georgia income tax credit – in other words, by contributing with dollars you must spend anyway – you will help maximize financial aid for deserving families desiring to receive a Marist School education.

-

How do I sign up?

Registration for the 2024 Georgia GOAL program is already in full-swing. Deadline is December 31.. Apply online today!

-

How to secure your contribution & 2024 tax credit

CLICK HERE for a step-by-step guide.

-

Can a corporation support GOAL?

Yes, click here to learn more.

-

What do business owners and tax advisors need to know?

CLICK HERE to find out more about business contributions and tax guidelines.